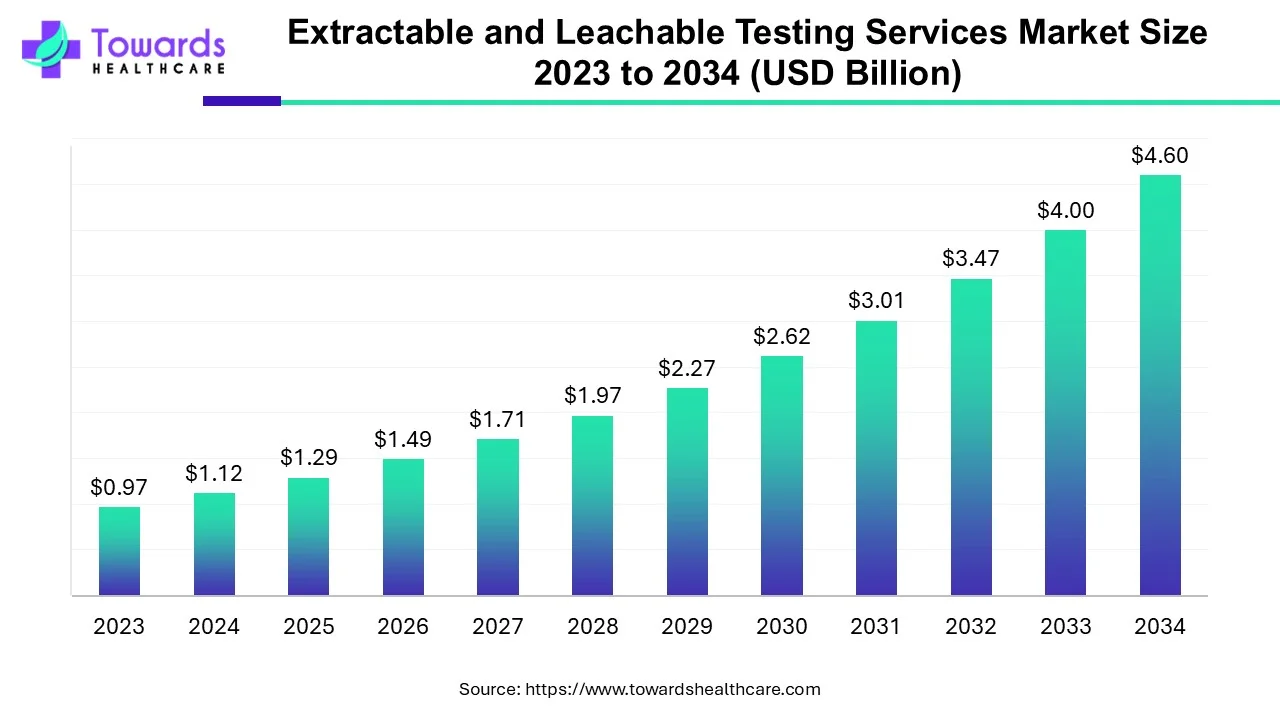

Extractable and Leachable Testing Services Market Size Drives at 15.17% CAGR by 2034

The global extractable and leachable (E&L) testing services market valued at USD 1.29 billion in 2025 projected to reach USD 4.6 billion by 2034, registering a CAGR of 15.17%.

Ottawa, Sept. 16, 2025 (GLOBE NEWSWIRE) -- According to a study by Towards Healthcare, a sister firm of Precedence Research, the global extractable and leachable testing services market was worth USD 1.12 billion in 2024. The market is expected to surge to nearly USD 4.6 billion by 2034, growing at a robust CAGR of 15.17% over the forecast period.

The extractable and leachable testing services market is rising due to stricter global regulatory requirements, increasing pharmaceutical and biopharmaceutical production, and growing reliance on advanced packaging and single-use systems that demand rigorous safety validation.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5381

Key Takeaways:

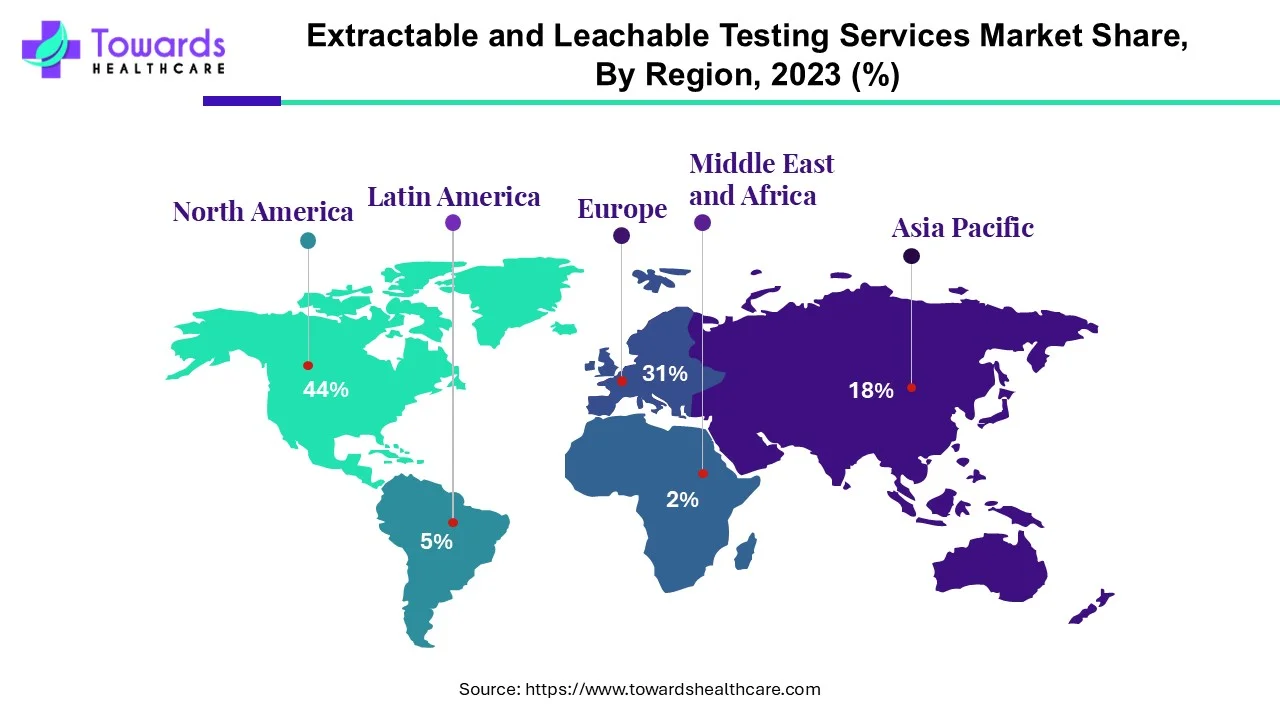

- North America dominated the global market share by 44% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product, the container closure system segment held the major market share in 2024.

- By product, the single-use systems segment is projected to grow at a CAGR between 2025 and 2034.

- By application, the orally inhaled and nasal drug products (OINDP) segment contributed the biggest market share in 2024.

- By application, the parenteral drug products segment is expanding at a significant CAGR between 2025 and 2034.

Market Overview:

The extractable and leachable testing services market generates analytical results for chemical compounds that can migrate away from packaging, container closure systems or process contact materials into active drug formulations or biologicals. Testing for extractable & leachable is directly related to patient safety, regulatory compliance (FDA, EMA, ICH etc), as well as ensuring product efficacy and stability/useful life.

Increasing amounts of pharmaceuticals and biopharmaceuticals produced, more innovative drug delivery modalities and increased scrutiny on packaging safety are driving the market. Dynamic advances in instrumentation from chromatography and mass spectrometry to increased sample preparation processes are enabling much more sensitive detection.

Major Growth Drivers:

- Regulations Impacting E&L Testing Demand: regulatory agencies globally are imposing stricter and stricter testing requirements for extractables and leachable especially for new dosage forms with sensitive dosages or high patient exposure. All manufacturers must comply with the requirements or they risk product delays.

- Increasing Biopharmaceutical and Pharmaceutical Output: New drugs, biologics and biosimilars are increasing directly equivalent to increases in the amount of material contact there will be. The more complex the formulation, with each new dosage or packaging innovation, creates potential leachable.

-

Technological Advances: Advanced analytical technologies such as high-resolution mass spectrometry, next-generation chromatography and sample prep automation, all serve to rapidly provide detection, lower detection thresholds for leachable, and all work together to provide accurate, fast, reliable and safer results.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Key Drifts:

What is Influencing the Market and the Trends in E&L Testing services?

The product and regulatory focus show that container closure systems dominate the E&L market in product type share, with extensive use and high risk of contact with drug substances. Single-use technologies are rising quickly in prevalence and use because they help minimize cleaning issues, but there are far more materials to with differing leachable that need characterizing. With drug product types, orally inhaled and nasal drug products (OINDP) dominate. These dosage forms are far more susceptible to leachable and traditionally require tighter control. Parenteral drug products are the fastest growing application, fuelled by the high demand for safety because they are injected, intravenous, etc.

Significant Challenge:

The capitalized need for costly equipment and controlled labs to develop could lead to thousands of dollars of cost per material/formulation for full extractables and leachable studies. Smaller firms or those in developing geographies often experience barriers with cost. We have a shortage of highly trained chemists or analysts with expertise in method development, sample prep, data, preparation, and understanding of regulation and material science; skills which need to work together in coordination to keep this industry growing, particularly in the emerging markets.

Regulatory bodies have different levels of thresholds, guidelines, or expectations for E&L testing, material databases are incomplete, and methods are not always harmonized. This situation results in duplication of effort, slower approval timelines, variations in results, and cost escalation.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis:

North America leads the extractables & leachable testing services market share by 44%, due to stringent FDA regulations, superior laboratory infrastructure and density of pharmaceuticals and biotechnology. The region benefits from high research and development spending, a rapid transition to new innovative package solutions, and the presence of global leaders.

Asia Pacific is the fastest growing region for Extractable and leachable testing services, given the growing pharmaceutical manufacturing hubs in China, India, and Japan. Regulatory enforcement is increasing, along with biologics production and investment in single-use technologies. Strong support from government initiatives and outsourcing in case of in-house identification and analysis are all reasons why APAC is the most dynamic growth region globally.

Segmental Insights:

By Product:

The container-closure systems dominated the market in 2024; this is primarily due to the regulatory expectations to test all materials that come in contact with drug, and container-closure systems can encompass any dosage form.

Single-use systems are continuing to expand rapidly given the trend for pharmaceutical manufacturers to utilize disposable process equipment, bag systems, and other consumables which all do have associated extractables/leachable testing.

By Application:

Orally inhaled and nasal drug products dominate the majority of share because of their high exposure risk, regulatory requirements, and patient safety concerns involve known material leachable undergoing rigorous testing.

The parenteral segment appears to be the fastest growing because, given the risk of leachable when the product is injected, regulators/companies are paying more attention to safety in the parenteral segment.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments:

- On January 31, 2024, Kindeva announced that its new Analytical Services Business Unit will offer extractables and leachable testing, elemental impurities assessment, medical device testing, and container-closure integrity testing.

- On March 21, 2024, Element Materials Technology Launches Rapid Response Pharmaceutical Testing Service. Element Materials Technology introduced a “Rapid Response Pharmaceutical Testing Service” at its Manchester lab to deliver faster turnaround times, including for E&L studies.

- In July 2023, Broughton Launches E&L Services for Reduced-Risk Nicotine Products: Broughton released adapted extractable and leachable testing services tailored to reduced‐risk nicotine industry products, targeting compliance pathways like PMTA and MAA.

Extractable and Leachable Testing Services Market Key Players

- Intertek Group plc

- Thermo Fisher Scientific

- Medical Engineering Technologies Ltd.

- Eurofins Scientific

- SCHOTT Pharma

- Nelson Labs

- SGS S.A.

- Sartorius AG

- Analytica Chemie Inc.

- Auriga Research Pvt. Ltd.

- Merck Millipore

- Dalton Pharma Services

- Gateway Analytical

Browse More Insights of Towards Healthcare:

The global drug discovery platforms market is valued at USD 186.24 million in 2024, expected to rise to USD 211.26 million in 2025, and projected to reach USD 635.45 million by 2034, expanding at a CAGR of 13.44% between 2025 and 2034.

The U.S. wound care centers market stands at USD 15.31 billion in 2024, grows to USD 16.1 billion in 2025, and is forecasted to reach USD 25.27 billion by 2034, advancing at a CAGR of 5.15% during 2025–2034.

The global disposable hospital supplies market is pegged at USD 26.69 billion in 2024, climbs to USD 29.08 billion in 2025, and is projected to hit USD 62.5 billion by 2034, witnessing a CAGR of 9.01% over the forecast period.

The global pharmaceutical CDMO market was valued at USD 146.05 billion in 2023 and is expected to reach USD 315.08 billion by 2034, growing steadily at a CAGR of 7.24% from 2024 to 2034.

The global home healthcare market is projected to surge from USD 226.92 billion in 2025 to USD 476.80 billion by 2034, expanding at a CAGR of 8.6% throughout the forecast timeline.

The global cold storage market is forecasted to grow from USD 172.98 billion in 2025 to USD 479.69 billion by 2034, progressing at a strong CAGR of 12% during the period.

The global healthcare contract research organization (CRO) market is valued at USD 53.87 billion in 2024, increases to USD 57.66 billion in 2025, and is expected to reach USD 106.25 billion by 2034, reflecting a CAGR of 7.04%.

The global cell & gene therapy logistics market is worth USD 1.45 billion in 2024, grows to USD 1.62 billion in 2025, and is anticipated to reach USD 4.33 billion by 2034, expanding at a CAGR of 11.54% from 2025 to 2034.

The global pulse oximeter market is valued at USD 3.56 billion in 2024, expected to increase to USD 3.8 billion in 2025, and projected to reach USD 6.76 billion by 2034.

The global medical billing outsourcing market is estimated at USD 15.45 billion in 2024, expands to USD 17.35 billion in 2025, and is forecasted to attain USD 49.26 billion by 2034, recording a CAGR of 12.3% between 2025 and 2034.

Segments Covered in the Report

By Product

- Container Closure Systems

- Single-Use Systems

- Drug Delivery Systems

- Others

By Application

- Parenteral Drug Products

- Orally Inhaled and Nasal Drug Products (OINDP)

- Ophthalmic

By Region

- North America

- US

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5381

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.