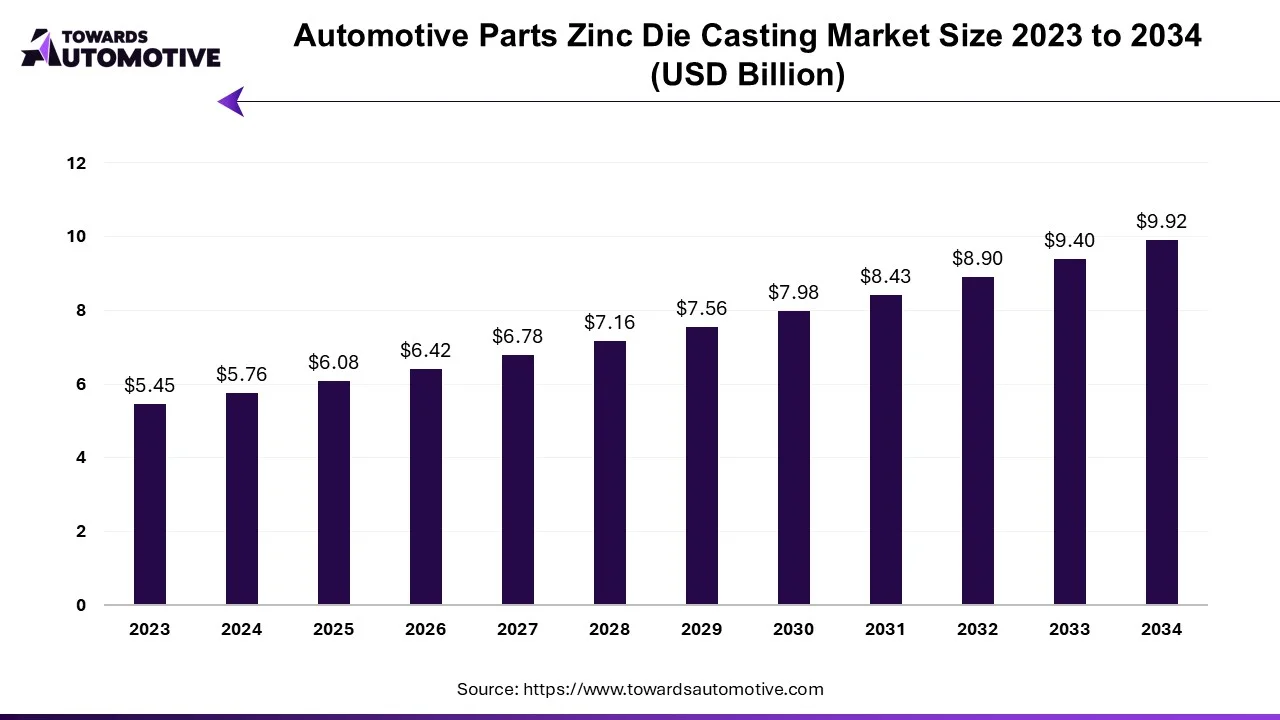

Automotive Parts Zinc Die Casting Market Worth USD 9.92 by 2034

According to a recent analysis by Towards Automotive, the global automotive parts zinc die casting market is projected to expand from USD 6.42 billion in 2026 to USD 9.92 billion by 2034, recording a CAGR of 5.6% between 2025 and 2034.

Ottawa, Sept. 17, 2025 (GLOBE NEWSWIRE) -- The global automotive parts zinc die casting market generated revenue of USD 6.08 billion in 2025, and this figure is projected to grow to USD 9.92 billion in 2034, according to research conducted by Towards Automotive, a sister firm of Precedence Research.

All the Stats, Charts & Insights You Need - Get the Databook Now: https://www.towardsautomotive.com/download-sample/1019

Market Overview

The automotive parts zinc die casting marketplace is a critical phase of the automobile production enterprise, pushed via increasing demand for lightweight, long lasting, and value-effective components.

Zinc Die casting offers fantastic dimensional accuracy, corrosion resistance, and the potential to form complicated shapes, making it best for generating elements along with door handles, carburetors, trademarks, and brackets. With growing emphasis on fuel performance and emission reduction, automakers are increasingly adopting zinc die casting to decorate overall performance while lowering car weight.

The automotive parts zinc die casting markets growth is being driven by the increasing need for lightweight and fuel-efficient vehicles, along with technological improvements. Besides, strict emission regulations and the penchant of customers for personalized and high-end cars are also spurring growth in the sector.

Major Trends in Automotive Parts Zinc Die Casting Market: Key Players & Recent Breakthroughs

| Major Trend | Competitors showing strength in that area | Recent Breakthrough / Innovation |

| Smart & Sustainable Manufacturing (automation, real-time tracking, AI, recycled zinc) | Dynacast, Sandhar Technologies Ltd, Nemak, Ryobi Die Casting Inc. | Adoption of vacuum die casting and integration of IoT/AI-based defect detection systems; increased use of recycled-zinc alloys to reduce carbon footprint. |

| Lightweighting & EV-Driven Metal/Alloy Innovation | Nemak, Dogger, AAMP, Meridian Lightweight Technologies | Development of new zinc alloy formulations with improved thermal conductivity and corrosion resistance; application in EV battery enclosures and motor housings. |

| Precision & Quality Improvements in Casting Processes | South Korean die casters, Dynacast, Brillcast, Pace Industries | Increased use of semi-solid casting, vacuum venting, dual-plunger gating, and computed tomography (CT) for porosity measurement; tighter tolerances and better finish. |

| Regional Growth & Capacity Expansion in Emerging Markets | Endurance Technologies, Sandhar Technologies, Castwel Auto Parts, Gibbs Die Casting | New manufacturing facilities established in Asia-Pacific; localized production and rising domestic vehicle output fueling demand. |

Automotive Parts Zinc Dies Casting Market Trends

- Sustainable Practices and Material Development: Companies in the automotive parts zinc die casting market are increasingly adopting sustainable practices and developing eco-friendly materials. They have adopted the use of recycled zinc and are implementing energy-efficient processes to contribute to reducing environmental impact while also meeting regulatory standards and consumer preferences regarding sustainability.

- Integration of IoT and Data Analytics: Integration of Internet of Things (IoT) technologies and data analytics solutions are revolutionizing the market. Real-time monitoring of equipment performance, predictive maintenance and data-driven decision-making tools help optimize production efficiency, minimize downtime and improve overall product quality.

- Advancements in Zinc Die Casting Technology: Significant innovations in zinc die casting technology have streamlined production processes, enhancing efficiency and precision in automotive parts manufacturing. With advancements like simulation software for mold design and real-time monitoring systems, manufacturers can now optimize product quality and reduce defects, thus boosting competitiveness in the market. These advancements lead to higher-quality automotive parts, reduced production costs and shorter lead times, driving the overall growth and competitiveness of the market.

- Improved Production Efficiency: Advanced die-casting techniques have revolutionized automotive manufacturing by significantly enhancing production efficiency through automated processes and innovative technologies. The implementation of high-pressure die-casting (HPDC) technologies has enabled manufacturers to replace almost 70 to 100 individual parts with a single cast component, dramatically reducing assembly complexity and manufacturing time.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Market Dynamics

Driver

Rise of lightweight vehicles and safety features

The increasing demand for lightweight vehicles is a major driver in the automotive parts zinc die casting market. As automakers aim to improve fuel efficiency and reduce emissions, they are increasingly using lightweight materials such as zinc die castings in the production of their vehicles. Zinc die castings are lighter than traditional materials such as steel and aluminum.

Additionally, they offer comparable strength and durability. This makes them an ideal choice for a variety of automotive applications, including body panels, structural components and powertrain components.

Another market driver is the increasing demand for safety features. Zinc die castings are used in a variety of safety-critical applications such as airbag housings, seatbelt buckles and brake components. They offer a number of advantages for use in safety applications dure to their ability to absorb energy as well as their high strength-to-weight ratio and corrosion resistance. This makes them a popular choice and further fuels the growth of the market.

Restraint

High Costs and Inconsistencies

Despite numerous advantages, the market faces several challenges. One significant challenge is the high initial cost that is associated with zinc die casting machinery and tooling. This can prove to be a barrier for small or medium scale manufacturers who may lack the capital to invest in advanced die casting technologies.

Moreover, zinc prices vary extensively because of geopolitical tensions, mining disruptions and other alternate limitations, using up manufacturing expenses and squeezing income margins for producers.

Additionally, clients also frequently face trouble differentiating between excessive-grade and substandard components, this happens mainly in unorganized markets. Inconsistent standards across providers and areas tend to complicate procurement. As vehicles become more complex, customers demand for more performance guarantees, putting a stress on producers to fulfill rising expectancies without any escalating fees.

Opportunity

Rise of EVs and Sustainability

As the automotive industry continues to grow, ample opportunities for the zinc die casting market continue to surface. The rise of electric vehicles presents a new, fresh platform for automotive parts manufacturers. EVs often require specific components that can benefit from zinc die casting due to their lightweight and durable properties.

Additionally, advancements in manufacturing technologies such as 3D printing and improved die design are paving the way for more efficient and cost-effective production processes. These technologies not only help reduce waste but also enhance the precision of parts, opening up new doors for growth within the market.

Another significant opportunity that is shaping the market is the escalating adoption of sustainable manufacturing practices. With a global increasing focus on environmental responsibility and circular economy principles, automotive stakeholders are prioritizing materials and processes that minimize ecological impact and align with global sustainability views.

Zinc die casting is known for its recyclability and low energy consumption during production. As the automotive industry moves toward eco-friendly alternatives, the demand for zinc die cast components is expected to keep growing.

More Insights of Towards Automotive:

- Cognitive Supply Chain Market Size Drives at 17.64% CAGR - The cognitive supply chain market is expected to increase from USD 10.41 billion in 2025 to USD 44.93 billion by 2034.

- E-Bike Market Size Driven by 7.05% CAGR - The e-bike market is anticipated to grow from USD 59.57 billion in 2025 to USD 109.98 billion by 2034.

- Mining Dump Trucks Market Driven by 5.92% CAGR - The mining dump trucks market is forecasted to expand from USD 30.73 billion in 2025 to USD 51.56 billion by 2034.

- Vehicle Toll Collection and Access Control Market Drives at 6.18% CAGR - The vehicle toll collection and access control market is projected to reach USD 21.43 billion by 2034, growing from USD 12.49 billion in 2025.

- Automotive Smart Glass Market Driven by 22.38% CAGR - The automotive smart glass market is forecasted to expand from USD 2.67 billion in 2025 to USD 16.41 billion by 2034.

- Electric Vehicle Security System Market Driven by 5.12% CAGR - The electric vehicle security system market is forecasted to expand from USD 49.71 billion in 2025 to USD 77.92 billion by 2034.

- Electric Vehicle Motor Communication Controller Market Drives at 15.48% CAGR - The electric vehicle motor communication controller market is forecasted to expand from USD 969.45 million in 2025 to USD 3,540.67 million by 2034.

- Automotive Torque Converter Market Driven by 5.56% CAGR - The automotive torque converter market is projected to reach USD 6.75 billion by 2034, growing from USD 4.15 billion in 2025.

- CNG and LPG Vehicle Market Size Driven by 4.93% CAGR - The CNG and LPG market is projected to reach USD 6.75 billion by 2034, expanding from USD 4.15 billion in 2025.

- Automotive Front End Module Market Driven by 4.86% CAGR - The automotive front end module market is forecasted to expand from USD 162.39 billion in 2025 to USD 248.92 billion by 2034.

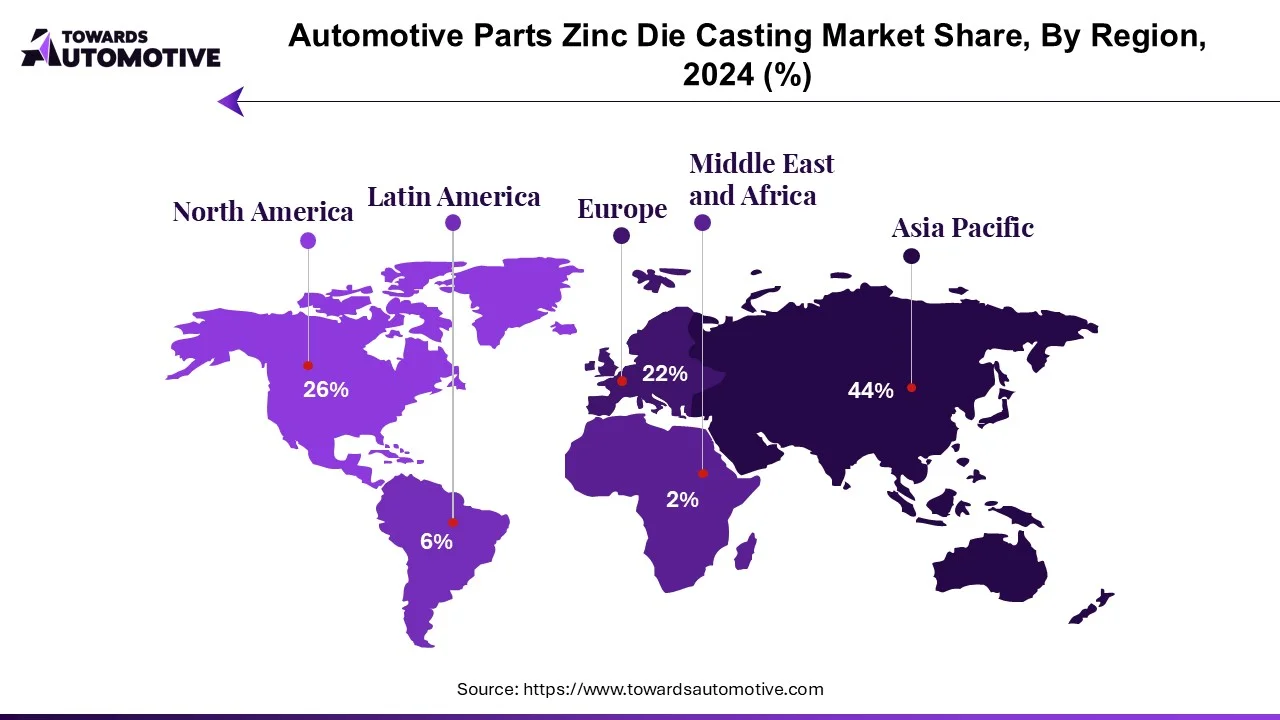

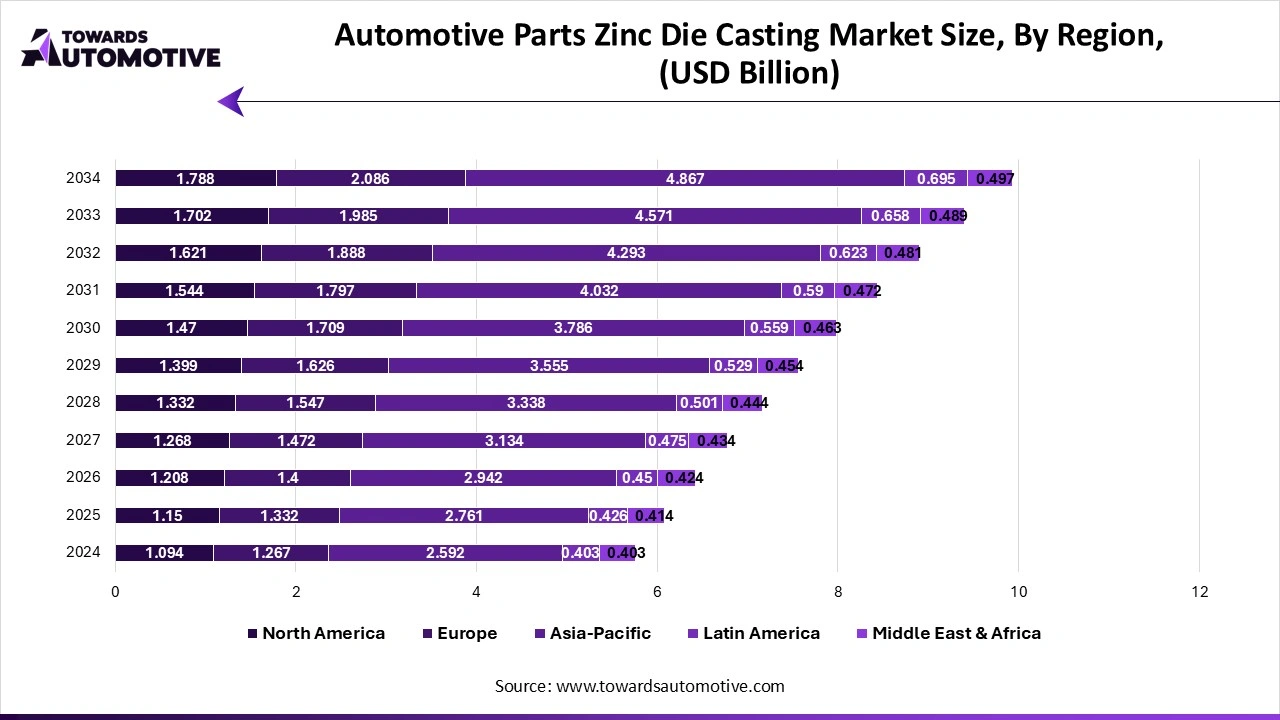

Regional Analysis

Why is Asia-Pacific dominating the market?

Asia-Pacific dominated the global zinc die casting market share because of its fast industrialization, growing automotive production and rising home demand in countries like China, India, Japan and South Korea.

The country benefits from low labor expenses, plentiful raw fabric availability and supportive regulations that entice international producers. In addition to that, the region’s expanding electric car region presents widespread increase in opportunities.

China Market Drivers:

- The country’s aggressive push towards electric mobility has boosted demand for lightweight zinc die cast components for various aspects.

- China has a vast availability of low-cost labor and raw materials which sustains the country’s position as the global hub for high volume zinc die casting.

- Chinese foundries are increasingly adopting robotic casting, AI based quality checks and IoT enabled monitoring to improve efficiency. This leads to the development of automation and Industry 4.0.

- The country’s strong automotive, especially to Europe and Asia-Pacific are creating higher demand for zinc high cast parts that meet international quality standards.

What are the advancements in North America?

North America is seen to be the fastest growing region. This growth is due to a strong demand for lightweight, excessive-performance additives in both traditional and electric powered motors.

The region benefits from superior manufacturing infrastructure, a well-set up automobile enterprise and expanded adoption of automation in die casting. The market is further pushed with the help of a sturdy cognizance on light-weight, durable components for fuel-green and electric powered vehicles. Advanced production technology and stringent emission guidelines also drive innovation across countries like U.S and Canada.

U.S Market Drivers:

- U.S manufacturers are increasingly adopting vaccum and semi solid die casting for improved strength and reduced porosity in critical parts.

- The country is also witnessing increased collaborations with OEMs and companies such as Ford, GM, Tesla etc. to design custom zinc die cast solutions tailored for specific automotive needs.

- There is an interest in reshoring manufacturing as the U.S is aimed at reducing reliance on Asian supply chains, driving new investments and opening up new opportunities.

- The demand for recycled zinc is on the rise as U.S regulators and automakers prioritize eco-friendly sourcing and sustainable options.

Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership

Segmental Analysis

Production Type Insights

Which production type dominated the market in 2024?

Pressure die-casting remains dominant in the automotive parts die casting market. This dominance can be attributed to its superior capabilities in producing intricate and complex components with high precision, making it particularly suitable for manufacturing modern, lightweight vehicle components.

The process offers faster cycle times and tighter tolerances compared to other casting methods, enabling manufacturers to produce thin-walled, complex parts efficiently. The segment's position is further strengthened by its extensive application in manufacturing engine boxes, gearbox casings and engine mounts, all of which are crucial for both traditional and electric vehicles.

Vacuum die casting is expected to be the fastest growing segment in the market. Reliability and efficiency are critical in the construction of automobiles, especially in the transmission process because they should be able to withstand pressure.

Here, the vacuum casting process can be used to design and manufacture valve bodies, stators and many other gearboxes as it can produce high-quality automotive parts.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardsautomotive.com/schedule-meeting

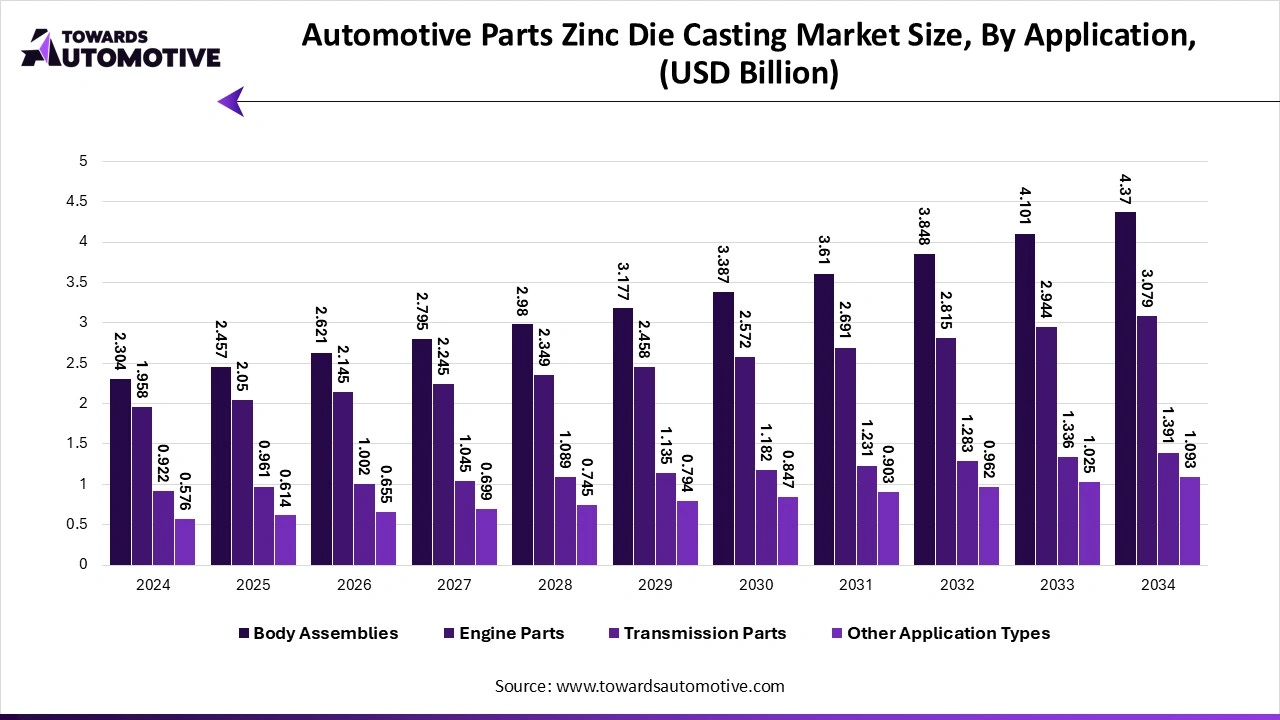

Application Type Insights

Which application type dominated the market this year?

Body assemblies dominated the market this year in 2024. This is driven by the increasing demand for lightweight vehicle components, particularly door frames, roof panels and other structural elements that require precision die casting.

The growing emphasis on vehicle weight reduction in order to improve fuel efficiency and meet stringent environmental regulations has further solidified the segment's position in the market. Additionally, the integration of advanced die-casting techniques such as high-pressure die-casting (HPDC) in automotive body assembly systems has enabled manufacturers to achieve superior dimensional accuracy and structural integrity while reducing manufacturing costs significantly.

The engine parts segment is projected to have the fastest growth throughout the forecast years. This growth can be attributed to the increasing adoption of electric vehicles worldwide and the subsequent demand for specialized engine components and electric battery housings. The segment's expansion is further supported by technological advancements in engine design that require more complex and precise die-cast components.

Manufacturers are increasingly investing in advanced die-casting technologies to produce lightweight engine parts that contribute to overall vehicle efficiency while maintaining structural integrity and performance standards.

Access our exclusive, data-rich dashboard dedicated to the Automotive Parts Zinc Die Casting Market designed specifically for decision-makers, strategists, and industry leaders. Towards Automotive dashboard offers in-depth statistical insights, segment-wise market analysis, regional share breakdowns, comprehensive company profiles, annual updates, and much more. From market sizing to competitive benchmarking, this all-in-one platform is your strategic gateway to smarter, data-driven decisions.

Access Now: https://www.towardsautomotive.com/contact-us

Top Key Players

- Sandhar Technologies Ltd

- Brillcast Manufacturing LLC

- Empire Casting Co.

- Dynacast

- Pace Industries

- Cascade Die Casting Group Inc.

- Minda Corporation Limited

- Bruschi S.p.A.

- PHB Corp.

- Ridco Zinc Die Casting Company

- Northwest Die Casting LLC

- Kemlows Diecasting Products Ltd

Recent Developments

- In January 2025, Hindustan Zinc introduced new zinc die casting alloys, HZDA 3 and HZDA 5, along with EcoZen, a low-carbon zinc product, at the Bharat Mobility Expo, aiming to expand India’s automotive materials options. The introduction of these die casting alloys aims to reduce India's dependence on imports for ZAMAK alloys, commonly used in automotive manufacturing. These alloys are designed for hot chamber die casting processes and provide dimensional stability and finishing properties for automotive components.

- In September 2025, Halla Cast begins mass production of humanoid parts by partnering with Global AI Automotive Companies. Active discussions are also underway with major overseas companies regarding both existing and new business areas. While the use of die-casting parts is being actively considered in serving, delivery, collaborative, and industrial automation robots, the company is also securing orders for humanoid AI robot parts, marking a full-fledged entry into the robotics sector.

Segments Covered in the Report

By Production Process Type

- Pressure die casting

- Vacuum die casting

- Other

By Application Type

- Body Assemblies

- Engine Parts

- Transmission Parts

- Other

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/price/1019

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardsautomotive.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardsautomotive.com

About Us

Towards Automotive is a leading research and consulting firm specializing in the global automotive industry. We deliver actionable insights across key segments such as electric vehicles (EVs), autonomous driving, connected cars, automotive software, aftermarket services, and more. Our expert team supports both global enterprises and start-ups with tailored research on market trends, technology, and consumer behavior. With a focus on accuracy and innovation, we empower clients to make informed decisions and stay competitive in a rapidly evolving landscape.

Stay Connected with Towards Automotive:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards AutoTech

- Read Our Printed Chronicle: Automotive Web Wire

- Visit Towards Automotive for In-depth Market Insights: Towards Automotive

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

- Get ahead of the trends – follow us for exclusive insights and industry updates: Tumbler | Bloglovin | Medium | Hashnode | Pinterest

Towards Automotive Releases Its Latest Insight - Check It Out:

- X-by-wire Systems Market Size - Driven by 36.77% CAGR

- Heavy-duty Tire Market Size - Drives at 3.37% CAGR

- Bicycle Accessories Market - Driven by 8.25% CAGR

- Yacht Charter Market Size - Drives at 5.23% CAGR

- High Performance Trucks Market - Driven by 4.14% CAGR

- Intelligent Traffic Management System Market - Driven by 15.25% CAGR

- Military Aerospace and Defense Lifecycle Management Market - Drives at 8.75% CAGR

- Automotive Spark Plugs and Glow Plugs Market - Drives at 3.28% CAGR

- Automotive Rubber-Molded Component Market - Driven by 6.21% CAGR

- Automotive Diagnostic Tools Market - Driven by 4.73% CAGR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.