Diagnostic Imaging Market Size is Expected to Reach USD 70.02 Bn by 2034 Technological Advancements and Growing Demand for Early Detection Drive Market Growth

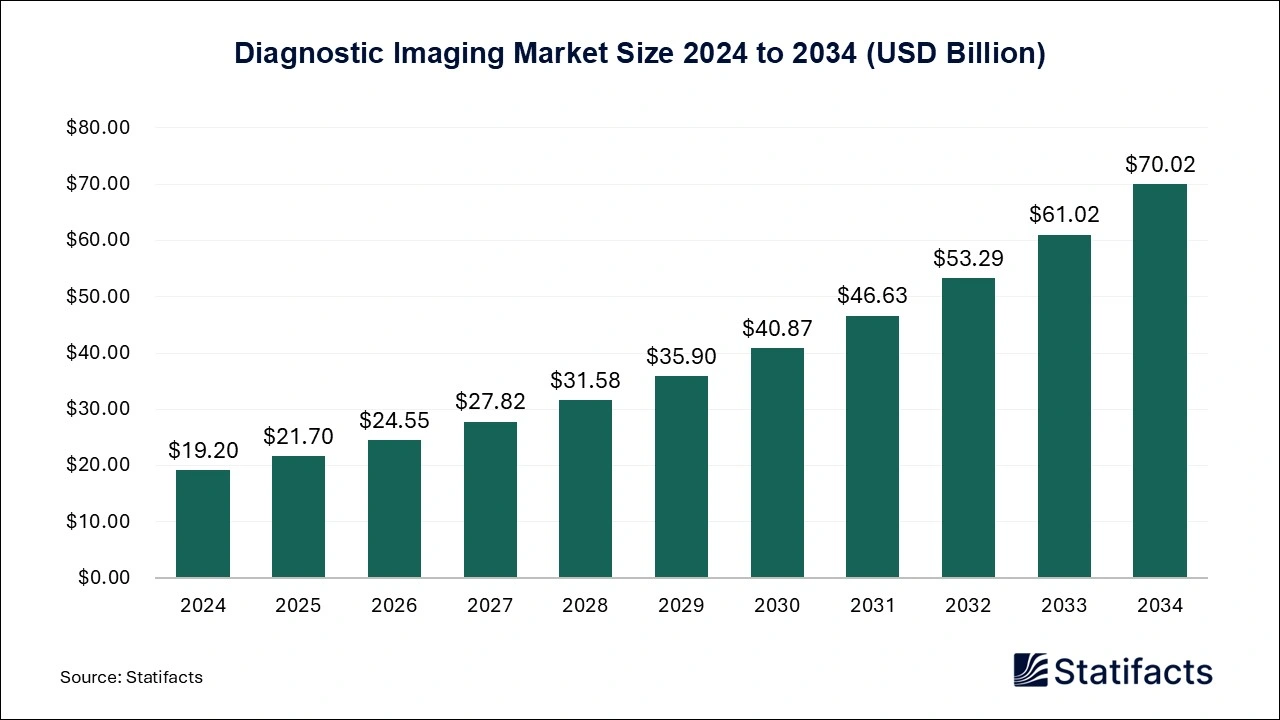

The global diagnostic imaging market is expected to grow significantly, reaching USD 70.02 billion by 2034, up from USD 21.7 billion in 2025, with a robust CAGR of 13.81% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Sept. 24, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global diagnostic imaging market size surpassed USD 19.2 billion in 2024 and is projected to hit approximately USD 70.02 billion by 2034, growing at a CAGR of 13.81% during the forecast period from 2025 to 2034. Technological innovation in diagnostic imaging, rising awareness of early disease detection, and the growing senior population are driving the market's growth.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8541

Diagnostic Imaging Market Highlights

- North America dominated the market in 2024 and is set to maintain its lead while growing at the fastest CAGR during the forecast period.

- Asia-Pacific recorded notable growth in 2024 and is projected to strengthen its position further over the coming years.

- By therapeutic application, ultrasound devices (portable and handheld) held the dominant share in 2024 and are expected to register the fastest CAGR moving forward.

- By therapeutic application, the X-ray systems segment accounted for a significant share in 2024 and is anticipated to witness considerable growth during the forecast period.

Diagnostic Imaging Market Size by Therapeutic Application, 2022 to 2024 (USD Million)

| Segments | 2024 | 2025 | 2034 |

| Ultrasound Devices (Portable, Handheld) | 8,931.79 | 10,163.80 | 34,920.23 |

| X-ray Systems (including C-arm systems) | 6,421.72 | 7,195.87 | 21,508.60 |

| Others | 3,849.29 | 4,336.38 | 13,587.59 |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

What is Diagnostic Imaging?

The diagnostic imaging market encompasses the production, distribution, and utilization of diagnostic imaging techniques, which involve various methods for visualizing the interior of the body to identify the causes of an illness or injury and confirm a diagnosis. Diagnostic imaging helps diagnose, monitor, and manage medical conditions affecting organs like the brain, breasts, lungs, heart, and others. The benefits of diagnostic imaging include that it gives healthcare providers a better view of organs, blood vessels, tissues, and bones. It provides detailed information to help decide whether surgery is a good treatment option. It can be used to guide medical procedures to place stents, catheters, or other devices inside the body.

Diagnostic imaging techniques are used to show internal structures under the skin and bone, and also to diagnose abnormalities and treat diseases. In September 2025, the launch of a major artificial intelligence (AI) initiative to enhance the scalability, efficiency, and accuracy of medical imaging analysis was announced by the National Institute of Health (NIH). Source: Mondaq

Artificial intelligence (AI) in diagnostic imaging has the potential to improve the accuracy and efficiency of interpreting medical images like CT scans, X-rays, and MRIs. AI algorithms can quickly analyze large amounts of imaging data, identifying patterns and abnormalities that may be overlooked by human eyes. AI algorithms can analyze medical images with remarkable accuracy and speed, and may surpass human capabilities. AI diagnostic imaging is transforming healthcare by improving diagnostic accuracy, improving radiology workflows, and allowing personalized treatment.

What are the Major Applications of Diagnostic Imaging?

- Oncology (Cancer Detection and Monitoring): Imaging techniques like CT, MRI, PET, and ultrasound are essential for detecting tumors, staging cancer, and monitoring treatment response.

- Cardiology (Heart and Vascular Imaging): Diagnostic imaging such as echocardiography, CT angiography, and MRI helps assess heart function, detect blockages, and diagnose vascular diseases.

- Neurology (Brain and Nervous System Imaging): MRI and CT scans are widely used to diagnose strokes, brain tumors, multiple sclerosis, and other neurological conditions.

- Orthopedics (Musculoskeletal Imaging): X-rays, MRI, and CT are used to evaluate fractures, joint disorders, soft tissue injuries, and degenerative diseases like arthritis.

-

Obstetrics and Gynecology (Women's Health Imaging): Ultrasound is commonly used to monitor fetal development during pregnancy, while MRI and mammography aid in detecting gynecological and breast conditions.

Key Market Trends

- Integration of Artificial Intelligence (AI) in Imaging: AI is transforming diagnostic imaging by automating image interpretation, improving diagnostic accuracy, and streamlining workflows. Radiologists are increasingly using AI tools to detect abnormalities such as tumors, fractures, and organ anomalies faster and more reliably.

- Growing Demand for Portable and Point-of-Care Imaging Devices: Compact and mobile imaging systems, especially handheld ultrasounds, are in high demand for use in emergency, ICU, and rural settings. These devices allow for faster diagnosis at the patient's bedside, improving outcomes and expanding access to care.

- Rise in Hybrid Imaging Modalities: Technologies like PET/CT, PET/MRI, and SPECT/CT are gaining popularity due to their ability to provide both functional and anatomical insights. This is especially valuable in oncology, cardiology, and neurology, where precise disease localization and monitoring are critical.

- Expansion of Cloud-Based Imaging and Teleradiology: Cloud storage and teleradiology platforms enable remote access to medical images and expert consultations across different locations. This trend supports telehealth, enhances collaboration, and speeds up diagnosis and treatment, especially in underserved areas.

-

Emphasis on Low-Dose and Patient-Friendly Imaging Solutions: Manufacturers are focusing on technologies that reduce radiation exposure while maintaining image quality.

Innovations also include quieter MRI machines, faster scan times, and ergonomic designs to improve patient comfort and safety.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8541

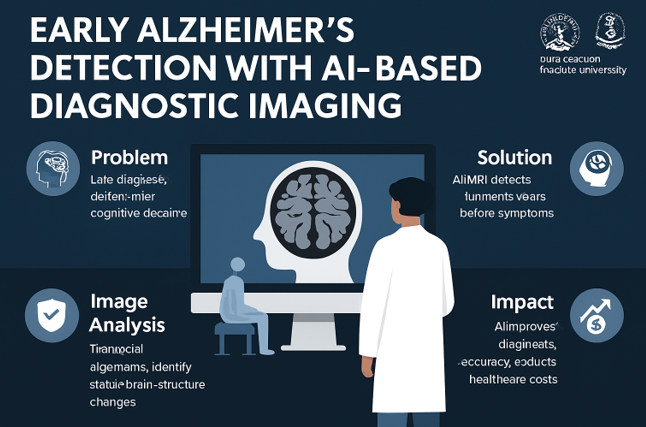

Case Study: AI-Powered Diagnostic Imaging for Early Alzheimer's Detection

The use of artificial intelligence (AI) in diagnostic imaging is revolutionizing the way healthcare providers identify and monitor diseases. One notable application is in the early detection of Alzheimer’s disease, where traditional methods often fail to catch the disease in its nascent stages. A breakthrough initiative led by King George's Medical University (KGMU) in India is leveraging AI-enhanced MRI scans to detect Alzheimer’s years before symptoms appear.

Problem:

Alzheimer's disease is notoriously difficult to diagnose early, with many cases only identified after significant cognitive decline has occurred. Current diagnostic methods, such as standard MRI, may not provide the early signs of the disease that are necessary for effective intervention. Early diagnosis is critical because it allows for timely treatment, which can slow the progression of the disease and improve patient outcomes.

Solution:

In 2025, researchers at King George’s Medical University introduced AI-based MRI scans to detect early signs of Alzheimer’s. By using advanced imaging techniques such as 3D imaging and diffusion imaging, the AI system analyzes brain changes that occur in the initial stages of Alzheimer's, often before visible symptoms are present.

- AI Algorithms: These algorithms are trained to detect subtle patterns and changes in the brain's structure that are indicative of the disease.

- Real-time Analysis: The AI processes the images rapidly, offering healthcare providers immediate insights that would otherwise take longer to analyze manually.

-

Accuracy: The AI system demonstrated a high level of accuracy in identifying patients at risk, significantly improving diagnostic precision.

Results:

The AI-based MRI system at KGMU has been able to detect Alzheimer’s at an early stage, allowing for early intervention and more personalized treatment plans. Early diagnosis has shown promise in improving long-term outcomes for patients by enabling early therapeutic interventions, slowing disease progression, and enhancing the quality of life.

Impact on the Market:

This use of AI in diagnostic imaging is part of a broader trend of integrating machine learning and deep learning algorithms into medical imaging. The adoption of AI tools in diagnostic imaging is expected to grow significantly, as AI algorithms can reduce human error, improve diagnostic speed, and ultimately lead to more effective healthcare solutions.

- Growth in AI-Driven Imaging Tools: The demand for AI-based imaging tools is expected to increase, particularly in areas like neurology, where early detection of diseases like Alzheimer’s can greatly impact patient outcomes.

- Cost-Effectiveness: By automating the image analysis process, AI reduces the workload on radiologists and helps healthcare providers reduce costs while improving diagnostic accuracy.

Impact of Global Events

The COVID-19 pandemic has significantly accelerated the adoption of remote diagnostic imaging and AI-assisted diagnostics. As healthcare systems around the world adapted to the challenges of the pandemic, there was a rapid shift toward telemedicine, and with it, a greater reliance on teleradiology and cloud-based image sharing. This shift not only enabled continued care during lockdowns but also sparked innovation in imaging technologies. The increased demand for portable and point-of-care imaging solutions during the pandemic is expected to have a lasting impact on the market, driving further growth in these segments.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8541

Diagnostic Imaging Market Dynamics

Drivers

- Rising healthcare spending: Rising healthcare costs include facilities, administration, pharmaceuticals, and medical operation costs. Healthcare providers are taking hits due to lower wages, staff shortages, and increased prices for medical supplies, which they then pass on to consumers at higher costs. High-quality healthcare helps to prevent diseases and enhance the quality of life. Payer management acts as an agent for consumer protection, budget constraints, and rapid increases in healthcare spending.

- Rising awareness of early disease detection: Early detection in disease management has been shown to have a major impact in improving patient prognosis and reducing healthcare costs. Early disease detection offers clear economic benefits. Investing in cost-effective screenings reduces financial burdens and saves lives. The benefits of early detection of disease include AI and digital screening, neurodegenerative disease detection, diabetes screening, cardiovascular health assessments, cancer screenings, cost-effectiveness for patients and the NHS, less intensive and more effective treatments, and enhanced survival rates.

Restraint

-

High cost of diagnostic imaging systems: The high cost of diagnostic imaging systems can hinder the growth of the diagnostic imaging market. Disadvantages of the increasing cost of diagnostic imaging due to rising resource constraints for use in other potentially effective areas, inadequate supply of imaging specialists to meet service demand, and spending their time on unnecessary tests, rising the risk of litigation because of increasing patient’s awareness and strengthening their knowledge about many aspects of their treatment to put them at risk of testing, and additional experiments leading to endangering patients.

Opportunity

-

Advancement of innovative technologies: There are many diagnostic imaging techniques used, including diagnostic sonography, digital mammography, single-photon emission computed tomography (SPECT), magnetic resonance imaging (MRI), positron emission tomography (PET), computed tomography (CT), and X-ray. These advanced diagnostic imaging technologies have many applications in the diagnosis of complex bone fractures, abdominal illnesses, congenital heart disease, neurological disorders, cancer of different tissues, myocardial diseases, and other serious medical conditions.

Challenges

- Regulatory Hurdles: Regulatory approval for new imaging technologies, especially in emerging markets, can slow down the market's adoption of innovative solutions. The time-consuming and costly process of gaining approval for new devices or AI-based applications remains a key obstacle.

- High Capital Expenditure: The significant cost of diagnostic imaging systems and associated maintenance can deter smaller healthcare facilities or those in developing regions from adopting the latest technologies.

-

Data Privacy Concerns: As more imaging data is stored and shared digitally, maintaining patient privacy and complying with increasingly stringent data protection laws is becoming more difficult.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8541

Diagnostic Imaging Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 19.2 Billion | |

| Market Size in 2025 | USD 21.7 Billion | |

| Market Size in 2028 | USD 31.58 Billion | |

| Market Size in 2032 | USD 53.29 Billion | |

| Market Size by 2034 | USD 70.02 Billion | |

| CAGR 2025-2034 | 13.81% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia-Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Therapeutic Application and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | GE Healthcare, Philips Healthcare, Hitachi Medical Corporation, Hologic, Inc., Siemens Healthcare, Samsung Medison, Shimadzu Corporation, Toshiba Medical Systems Corporation, Esaote S.P.A, Fujifilm Corporation, and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Diagnostic Imaging Market Segmentation

Therapeutic Application Insights

Which Therapeutic Application Segment Dominates the Diagnostic Imaging Market?

The ultrasound devices (portable, handheld) segment held a dominant presence in the diagnostic imaging market in 2024. Ultrasound techniques are relatively inexpensive compared to other diagnostic imaging tests, making them affordable for many patients. Ultrasound devices are used in diagnostic imaging due to their ability to capture images in real-time. They can also show the movement of the body’s internal organs, as well as blood flowing through the blood vessels. As compared to X-ray imaging, there is no ionizing radiation exposure associated with ultrasound devices. Since images are created and viewed in real-time, clinicians can make immediate assessments and decisions about the next steps in care.

The X-ray systems (including C-arm systems) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. X-ray imaging is used to help diagnose disease and monitor therapy, support medical and surgical treatment planning, and guide medical personnel as they insert stents, catheters, or other devices inside the body, treat tumors, or remove blood clots or other blockages. Digital X-ray technology transformed the field of diagnostic imaging, providing many benefits over traditional film-based X-rays. X-ray systems are used in many medical fields, including cardiology, dentistry, and orthopedics. The benefits of X-ray systems include cost-effectiveness, environmental friendliness, easy image storing and sharing, immediate results, reduced radiation exposure, and improved image quality.

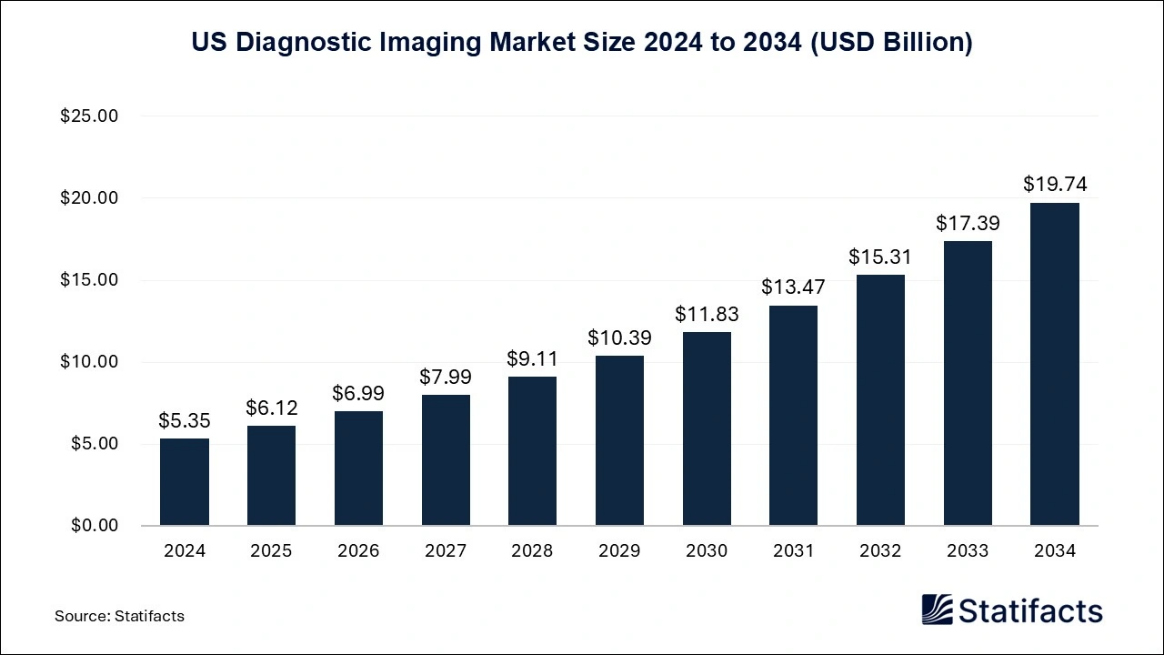

U.S. Diagnostic Imaging Market Size 2025 to 2034 (USD Billion)

The U.S. diagnostic imaging market size accounted for USD 5.35 billion in 2024 and is predicted to touch around USD 19.74 billion by 2034, growing at a CAGR of 13.94% from 2025 to 2034.

North America Diagnostic Imaging Market

North America dominated the global market in 2024 due to the rising prevalence of chronic diseases like neurological disorders and cancer, an aging global population, diagnostic solutions, and medical imaging technologies in the North American region. North America has a robust healthcare infrastructure, and it focuses on early adoption of cutting-edge technologies.

The strong presence of major global imaging equipment manufacturers in the U.S. is solidifying its regional position in the global market. Additionally, the strong investments in research and development with a strong emphasis on integration of AI and digital health solutions are fostering this growth. According to a report published in 2025 by Definitive Healthcare Platform, it tracks more than 15000active imaging centers across the U.S. Source: Definitive Healthcare

The U.S. has dominated the regional market due to its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and strong presence of leading imaging equipment manufacturers such as GE Healthcare, Philips, and Siemens Healthineers. The country’s robust investment in research and development, along with widespread access to imaging services, drives continuous innovation and early adoption of AI-integrated and hybrid imaging systems. Additionally, the high prevalence of chronic diseases, an aging population, and favorable reimbursement policies further fuel demand for diagnostic imaging procedures, solidifying the U.S. as the regional market leader.

Asia Pacific Diagnostic Imaging Market

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Because of the technological innovation in diagnostic imaging, adoption of point of care and portable devices, precision & personalized imaging, integration of teleradiology services, and AI-based diagnostic imaging solutions in the Asia Pacific region. India currently imports almost all major imaging equipment for diagnostics. Technological innovations and advances for affordable portable imaging devices are contributing to increasing adoption of diagnostic imaging across the Asian healthcare infrastructure. Countries like China, India, Japan, and South Korea are fueling the rising adoption of cutting-edge imaging modalities.

China is a major player in the regional market due to its rapidly expanding healthcare infrastructure, large patient population, and increasing government investments in advanced medical technologies. The country’s focus on modernizing hospitals and expanding access to diagnostic services, especially in tier-2 and tier-3 cities, has driven strong demand for a wide range of imaging modalities such as MRI, CT, and ultrasound. Additionally, growing awareness of chronic diseases, rising healthcare expenditure, and the presence of both domestic and international imaging equipment manufacturers have accelerated market growth, positioning China as the key leader in the Asia-Pacific region.

Browse More Research Reports:

- The global diagnostic imaging equipment market size surpassed USD 21.14 billion in 2024 and is predicted to reach around USD 72.48 billion by 2034, registering a CAGR of 13.11% from 2025 to 2034.

- The global pipeline inspection and diagnostic market, valued at USD 7,131 million in 2024, is forecast to reach USD 12,531.62 million by 2034, growing at a 5.8% CAGR as demand for safe, efficient, and technology-driven energy infrastructure monitoring rises.

- The global in vitro diagnostic (IVD) reagents market size surpassed USD 42.51 billion in 2024 and is predicted to reach around USD 71.93 billion by 2034, registering a CAGR of 5.4% from 2025 to 2034.

- The U.S. home diagnostics market size accounted for USD 4.17 billion in 2024 and is predicted to touch around USD 7.49 billion by 2034, growing at a CAGR of 6.03% from 2025 to 2034.

- The global home diagnostics market size was evaluated at USD 11.55 billion in 2024 and is expected to grow around USD 22.23 billion by 2034, registering a CAGR of 6.76% from 2025 to 2034.

- The U.S. infectious disease in vitro diagnostics market size accounted for USD 7,510 million in 2024 and is predicted to touch around USD 9,800 million by 2034, growing at a CAGR of 2.7% from 2025 to 2034.

- The U.S. breast cancer diagnostics market size is calculated at USD 7,809 million in 2024 and is predicted to attain around USD 16,703 million by 2034, expanding at a CAGR of 7.9% from 2025 to 2034.

- The global HIV diagnostics market size was evaluated at USD 3,498 million in 2024 and is expected to grow around USD 7,277 million by 2034, registering a CAGR of 7.6% from 2025 to 2034.

- The global veterinary point of care diagnostics market size surpassed USD 1,992 million in 2024 and is predicted to reach around USD 5,261 million by 2034, registering a CAGR of 10.2% from 2025 to 2034.

- The global DNA diagnostics market size was estimated at USD 27.10 billion in 2024 and is projected to be worth around USD 57.96 billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034.

- The global diagnostic testing market size was estimated at USD 203.26 billion in 2024 and is projected to be worth around USD 275.83 billion by 2034, growing at a CAGR of 3.1% from 2025 to 2034.

- The global point-of-care molecular diagnostics market size accounted for USD 8,670 million in 2024 and is predicted to touch around USD 12,710 million by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8541

Top Companies in the Diagnostic Imaging Market

- Fujifilm Corporation – Offers advanced X-ray, ultrasound, and AI-powered diagnostic imaging systems.

- Esaote S.P.A. – Specializes in ultrasound and dedicated MRI systems for human and veterinary diagnostics.

- Toshiba Medical Systems Corporation – Provides comprehensive CT, MRI, ultrasound, and X-ray imaging solutions.

- Shimadzu Corporation – Delivers high-resolution radiography, fluoroscopy, and angiography imaging systems.

- Samsung Medison – Develops innovative ultrasound technologies for precise clinical imaging.

- Siemens Healthcare – Offers a full suite of imaging systems, integrating AI for enhanced diagnostic capabilities.

- Hologic, Inc. – Focuses on women’s health imaging, particularly digital mammography and breast diagnostics.

- Hitachi Medical Corporation – Designed patient-friendly MRI, CT, and ultrasound systems with advanced imaging features.

- Philips Healthcare – Provides intelligent MRI, CT, ultrasound, and molecular imaging solutions.

- GE Healthcare – Offers a wide range of diagnostic imaging systems with AI tools for faster, accurate diagnosis.

Recent Developments

- In July 2025, the commercial availability of an advanced floor-mounted digital X-ray system, Definium Pace Select ET, designed to deliver high-image quality and improve efficiency in highly demanding environments, while improving access and affordability, was announced by GE HealthCare. GE Healthcare’s new Definium Pace Select ET helps with these challenges by automating manual, repetitive steps and helping to eliminate physical strain. Source: ITN online

- In September 2025, the inauguration of the ‘Bayer Development Center in Radiology’ at Tata Elxsi, Pune, India, was announced by Tata Elxsi, a global leader in design and technology services. This center is designed to develop with Bayer, a leader in key areas of Radiology, advanced radiology technology, and devices that allow accurate and early diagnosis and treatment of critical illnesses, supporting Bayer’s global mission to bring compliant, innovative, and safe solutions to patients and clinical staff worldwide. Source: PR Newswire

Segments Covered in the Report

By Therapeutic Application

- Ultrasound Devices (Portable, Handheld)

- X-ray Systems (including C-arm systems)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Vitamin D Market - https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market - https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market - https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market - https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market - https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market - https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market - https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market - https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

- Quantum Encryption Communication Modules Market - https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market - https://www.statifacts.com/outlook/automotive-copper-core-cable-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.