Copper Market Size to Cross USD 456.61 Billion by 2034

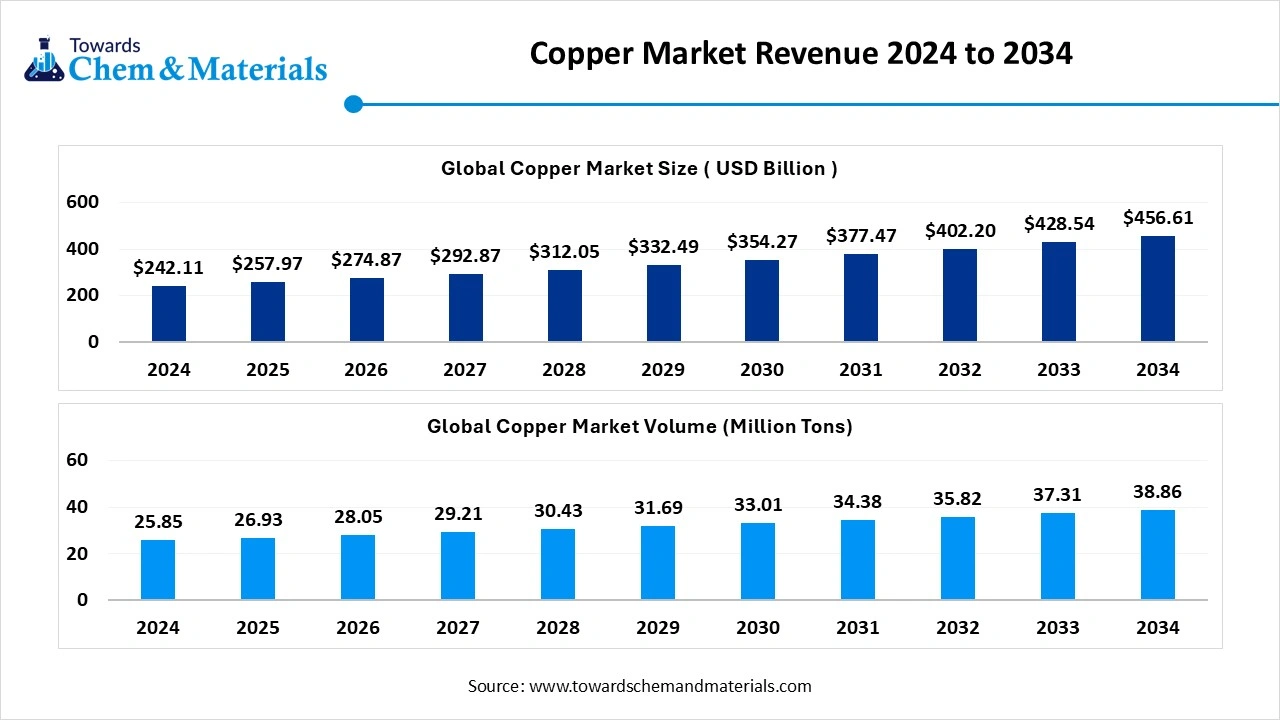

According to Towards Chemical and Materials, the global copper market size is calculated at USD 257.97 billion in 2025 and is expected to be worth around USD 456.61 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.55% over the forecast period 2025 to 2034.

Ottawa, Oct. 14, 2025 (GLOBE NEWSWIRE) -- The global copper market size was valued at USD 242.11 billion in 2024 and is anticipated to reach around USD 456.61 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.55 % over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

According to Towards Chemical and Materials, the global copper market is experiencing rapid growth, with volumes expected to increase from 26.93 million tons in 2025 to 38.86 million tons by 2034, representing a robust CAGR of 4.16% over the forecast period.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5672

Copper Overview

The global copper market is experiencing robust growth, driven by increasing demand across various sectors, including electrical and electronics, construction, and transportation. The shift towards renewable energy sources, such as solar and wind power, has significantly boosted the need for copper in infrastructure development. Additionally, the rise in electric vehicle production has further intensified copper consumption, as these vehicles require more copper than traditional internal combustion engine vehicles. Technological advancements and innovation in copper processing and recycling are also contributing to the market’s expansion.

Copper Market Key Factors Behind the Recent Price Surge

- Supply Disruptions: Major production challenges across key mining regions have created significant supply shortfalls. Recent mining disruptions in several copper-producing countries have tightened market conditions considerably, leaving buyers competing for limited available supply.

- Currency Influences: The weakening U.S. dollar has played a substantial role in supporting copper prices. As the dollar loses strength against major currencies, dollar-denominated commodities like copper become more affordable for buyers using other currencies, stimulating additional demand.

-

Structural Market Changes: The copper market is experiencing a fundamental transformation as demand shifts from traditional industrial cycles to green energy applications. This evolution creates new consumption patterns that may be less cyclical and more structurally persistent than historical demand trends.

What Role Is China Playing in Copper Market Dynamics?

China's influence on global copper markets remains paramount, with its consumption patterns, strategic priorities, and economic policies serving as critical price determinants. Understanding Chinese market behavior provides essential context for interpreting current price trends.

Chinese Demand Patterns

China's consumption patterns remain the dominant influence on global copper markets, accounting for approximately 50% of global refined copper demand. Recent industrial recovery efforts and infrastructure stimulus measures have provided support for prices.

This outsized market share means even modest changes in Chinese consumption patterns can create significant global market impacts. Recent industrial recovery efforts following pandemic-related disruptions, coupled with infrastructure stimulus initiatives, have underpinned price strength through 2025.

The country's Five-Year Plan priorities and infrastructure development goals continue to drive substantial copper price prediction requirements across construction, manufacturing, power infrastructure, and transportation sectors. These strategic imperatives provide a floor for Chinese copper demand even during periods of broader economic adjustment.

Price Sensitivity Thresholds

Market analysts have identified key price thresholds where Chinese buyers may adjust their purchasing behavior:

| Price Level (USD/ton) | Expected Buyer Response |

| Below $9,000 | Aggressive purchasing |

| $9,000-$11,000 | Normal procurement |

| Above $11,000 | Potential demand destruction |

These thresholds reflect both economic considerations and strategic priorities. At lower price points, Chinese buyers often accelerate purchases to build inventories and secure supply. As observed in mid-2024, when prices exceeded $11,000 per ton, Chinese buyers demonstrated restraint, implementing a more selective procurement approach.

Understanding these behavioral thresholds provides valuable insight into potential price ceiling effects. The current price level around $10,775 sits near the upper boundary of normal procurement behavior, suggesting prices may face resistance if they move substantially higher.

Strategic Stockpiling

China's strategic metal reserve activities can significantly influence market sentiment and price direction, though these movements are often not transparent to market participants.

The country's State Reserve Bureau periodically engages in both buying and selling activities as part of its broader commodity management strategy. These interventions, which can involve substantial volumes, often occur with limited market visibility, creating price volatility when they become known.

Beyond official stockpiles, various forms of "invisible inventory" exist throughout China's industrial supply chain, providing buffers against supply disruptions and price volatility. These inventories can be rapidly deployed during periods of market tightness, potentially dampening price rallies.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5672

Copper Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 274.87 billion |

| Revenue forecast in 2034 | USD 456.61 billion |

| Growth rate | CAGR of 6.55% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2022 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Application, By End-User Industry, By Form, By Distribution Channel, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE |

| Key companies profiled | Jiangxi Copper Corporation; Aurubis AG; Codelco; Glencore; BHP; AngloAmerican; Teck Resources Limited; Antofagasta plc.; KGHM; Rio Tinto; Freeport-McMoRan; GRUPO MÉXICO |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Is Driving the Current Copper Price Rally?

Copper futures have surged to their highest levels since May 2024, with prices reaching approximately $10,775 per metric ton as of October 2025. This remarkable 3.45% daily gain marks the second-largest increase in a 30-day period, signaling renewed momentum in the copper market. The rally reflects a complex interplay of several critical factors reshaping market dynamics.

The recent price surge stems primarily from supply constraints across major mining regions, coupled with a weakening U.S. dollar that has provided substantial support for commodity prices globally. Beyond these short-term catalysts, a fundamental structural shift is occurring as copper demand transitions from traditional industrial cycles to green energy applications.

Market analysts note that while supply disruptions and currency dynamics have driven the initial price movement, sustained momentum will require stronger demand signals, particularly from China. The current rally demonstrates copper's unique position at the intersection of industrial demand, monetary policy impacts, and emerging green economy requirements.

How Are Supply Constraints Affecting Copper Markets?

The copper supply chain faces significant challenges that have created a persistent market tightness. Production issues across multiple regions have converged to create favorable pricing conditions that cannot be quickly resolved through normal market mechanisms.

Global Production Challenges

Recent mining disruptions have significantly tightened copper supply chains worldwide. Production challenges in major copper-producing regions have created a supply deficit that continues to support higher prices. These disruptions range from operational issues at established mines to delays in bringing new capacity online.

The impact of these challenges is magnified by copper's critical role in multiple industrial applications, creating a situation where even modest production shortfalls can have outsized price impacts. With limited inventory buffers, the market has become increasingly sensitive to any news of potential supply interruptions.

Mine Development Limitations

New copper project development remains constrained by several factors that limit the industry's ability to respond to price signals:

- Environmental permitting delays have extended project timelines by years in some cases, as regulatory requirements become increasingly stringent

- Rising capital expenditure requirements mean new projects require significantly higher copper prices to achieve acceptable returns, with some developments now costing billions rather than millions to bring online

- Technical challenges in developing lower-grade deposits as the industry moves from easily accessible high-grade ore bodies to more complex, deeper, or lower-grade resources

- Political uncertainties in key mining jurisdictions create additional risk premiums for projects in regions with evolving regulatory frameworks or resource nationalism concerns

Supply Response Timeline

The copper market faces a structural challenge: even with current price incentives, new mine development typically requires 7-10 years from discovery to production. This extended timeline means supply cannot quickly respond to price signals, creating persistent market imbalances.

This development cycle creates a fundamental mismatch between market signals and supply responses. By the time new production comes online in response to today's high prices, market conditions may have changed significantly. This dynamic contributes to the boom-bust cycles that have historically characterized copper markets.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5672

Here Are Some Of The Top Products In The Copper Market

1. Copper Wire

- Used in electrical wiring due to excellent conductivity, essential in buildings, electronics, and power systems.

2. Copper Tubing/Pipes

- Common in plumbing, heating, and cooling systems (HVAC); valued for corrosion resistance.

3. Copper Rods and Bars

- Used in electrical applications, motors, and construction industries.

4. Copper Sheets/Plates

- Applied in roofing, construction, industrial machinery, and decorative items.

5. Copper Cathodes

- Pure copper slabs used as the base for manufacturing other copper products; key traded form.

6. Copper Alloys (e.g., Bronze, Brass)

- Used in coins, musical instruments, fittings, and marine hardware.

7. Copper Foil

- Critical in electronics, especially in lithium-ion batteries and printed circuit boards (PCBs).

8. Copper Powder

- Used in additive manufacturing, metallurgy, and chemical applications.

9. Copper Granules/Scrap

- Recycled copper for reprocessing, vital to sustainable copper supply.

10. Copper Conductors/Cables

- Used in energy transmission, renewable energy systems, and telecommunications.

What Are The Major Trends In The Copper Market?

- The global shift toward electrification and renewable energy sources, such as solar and wind power, is significantly driving copper demand due to its essential role in electrical systems and power generation infrastructure.

- The increasing adoption of electric vehicles is boosting the need for copper, as these vehicles require more copper than traditional internal combustion engine vehicles, particularly in batteries and electric drivetrains.

- There is a growing emphasis on copper recycling, supported by regulations and sustainability goals, to reduce environmental impact and meet the rising demand for copper in various industries.

Copper Market Dynamics

Could Supply Disruptions Spark Copper Demand?

Recent operational setbacks at major mining sites, have squeezed output and heightened concern over tight supply in the industry, pushing buyers to compete more aggressively for available.

Will Electrification And Green Tech Drive Copper’s Future?

As artificial intelligence deployments expand, data centres demand more copper for power delivery, cooling and interconnects, making copper a critical input in the backbone of digital infrastructure.

Market Opportunity

Could Copper Recycling A New Supply Source?

With extraction challenges mounting, greater emphasis is being placed on recovering copper from of life electronics, wires, and industrial scrap, offering a sustainable pathway to supplement mined copper.

Might Mine Electrification Help Redefine Sustainable Production?

Mining operators are increasingly converting diesel fleets and equipment to battery electric systems under pressure to cut emissions, presenting opportunities for copper to feature in new infrastructure and energy systems.

Limitations In The Copper Market

- Supply volatility and operational disruptions in key mining regions undermine copper availability and raise cost uncertainty.

- Rising regulatory pressures, stricter environmental norms, and permitting delays contain development of new mines and expansion of existing operations.

Copper Market Segmentation Insights

Product Type Insights

Why Did The Refined Copper Segment Dominated The Copper Market In 2024?

The refined copper segment led the market in 2024. This dominance is shaped by its widespread use across industries, from construction and power infrastructure to electronics and industrial machinery. Refined copper continues to be essential because of its high conductivity and durability, making it a preferred material for wiring, cabling, and energy transmission, reinforces its string position in the copper market and underlines why refined copper remains the backbone of supply chains across sectors.

The copper wire rods segment is expected to grow at the fastest rate in the market during the forecast period. This growth is driven by the rising demand for efficient transmission in power grids, electric vehicles, and renewable energy systems, where wire rods serve as a critical input. As nations expand infrastructure and renewable integration accelerates, wire rods are gaining greater importance of high performance applications. The increasing shift toward electrification and digital connectivity makes copper wire rods future ready material, ensuring strong opportunities for expansion in the years ahead.

Application Type Insights

Why Did The Electrical And Electronics Segment Dominated The Copper Market In 2024?

The electrical and electronics segment registered its dominance over the market in 2024. This is largely due to copper’s unmatched role in wiring, circuits, and components that power consumer electronics, appliances, and industrial equipment. With technological innovation advancing rapidly, the reliance on copper for high efficiency electrical systems continues to be deep rooted. The expansion of communication networks, smart devices, and automation technologies further secures the electrical and electronics segment’s dominance, making in the core application area of the copper market.

The renewable energy segment is set to experience the fastest rate is the market growth from 2025 to 2034. Renewable projects such as wind farms, solar plants, and energy storage systems require large volumes of copper for turbines, panels, and power lines. As global energy systems transition toward greener sources, copper demand in this segment is surging. The renewable energy shift not only creates opportunities for large scale deployment of copper but also enhances it importance as a sustainable material supporting low carbon growth.

End Use Industry Insights

Why Did The Power Generation And Construction Segment Dominated The Copper Market In 2024?

The power generation and construction segment led the copper market in 2024. Copper’s role in grid expansion, residential and commercial construction, and urban development projects cement its stronghold. It remains indispensable for power lines, transformers, and construction wiring, making it the foundation of modern infrastructure. As economies grow and invest in new energy and housing projects, this segment consistently reaffirms its dominant role in copper demand.

The automotive and EV industry segment is projected to expand rapidly in the market in the coming years. Electric vehicles require far more copper than traditional cars, with application in motors, batteries and chagrining infrastructure. The global shift toward cleaner mobility is fuelling this demand surge, as governments and manufacturers accelerate EV adoption. This makes the automotive and EV segment one of the most dynamic opportunities for copper, tying the metal’s growth trajectory directly to the future of sustainable transportation.

Form Type Insights

Why Did The Bare Copper Segment Dominated The Copper Market In 2024?

The bare copper segment dominated the market in 2024. Bare copper is widely used in electrical wiring, cables, and conductors due to its high conductivity and reliability. It remains the most straightforward and widely demanded form, serving industries that depend on uninterrupted energy transfer. Its cost effectiveness and efficiency have allowed it to remain a top choice in construction, utilities, and industrial applications, thereby maintaining its strong position.

The recycled copper segment is projected to grow with the highest CAGR in the market during the studied years. Growing environmental concerns and sustainability goals are driving industries to increase reliance on recycled copper, which reduces the need for new mining and lowers environmental impact. As regulations support circular economy initiatives, recycled copper is margining as a vital source if supply. This trend not only addresses sustainability but also helps stabilize copper availability in times of mining constraints.

Distribution Channel Insights

Why Did The Direct Sales Segment Dominated The Copper Market In 2024?

The direct sales segment dominated the market in 2024. This is because industries with large copper requirements prefer direct supply from producers to ensure quality, reliability, and steady flow materials. Direct sales channels also help buyers establish strong relationship with suppliers, enabling better control over contracts and deliveries. This method continues to dominate as a trusted an efficient way of sourcing copper for high value industries.

The online metal marketplaces segment is anticipated to grow with the highest CAGR in the market during the forecast period. Digital platforms are transforming the way copper is bought and sold, offering transparency, wider access, and faster procurement. As industries adopt digital solutions for supply chains, online marketplaces are becoming increasingly relevant. Their ability to simplify transactions and expand reach across geographies positions them as the fastest growing channel in the market.

Regional Insights

Which Region Asia Pacific Dominates The Global Copper Market?

The Asia-Pacific copper market size is calculated at USD 180.91 billion in 2024, grew to USD 192.92 billion in 2025, and is projected to reach around USD 344.08 billion by 2034. The market is expanding at a CAGR of 6.64% between 2025 and 2034.

Asia Pacific held the top position in the copper market in 2024, its strong industrial base, rapid urbanization, heavy investment in infrastructure, and dominant role in electronics and power generation sectors. The region’s demand for copper in construction, grid expansion, and manufacturing underpins its influence in the global landscape. Moreover, policies in countries across the region continuously favour development of smart infrastructure, renewable energy, and electric mobility, all of which drive copper consumption.

China stands out as a pivotal force in the Asia Pacific copper market, propelled by its massive scale in manufacturing, infrastructure development, and its leading role in electric vehicle production and renewable energy deployment. India is emerging as a key growth frontier, with rising infrastructure ambitious and increasing focus on domestic copper production capacity. Tighter, these two nations shape demand trends, investment directions, and supply chain strategies in the regional copper ecosystem.

Why Is Latin America Viewed As The Fastest Region In The Copper Market?

Latin America expects the fastest growth in the market during the studied years. The region benefits from momentum in mining investment and infrastructure expansion. The region benefits from increasing exploration activity and heightens global demand, specially from green energy and power sectors, which amplifies expectations for rapid growth. Producers in improving yield and supply potential. Also, favourable geological endowments paired with rising export demand help elevate Latin America’s position in the global copper supply chain. Overall Latin America is shaping up as a region where untapped capacity and rising demand combine to drive strong growth outlook.

Brazil is emerging as a key player within Latin America’s copper market, boosting both production and downstream processing capacities. Domestic demand from sectors like construction, electrical infrastructure, and manufacturing has been rising, encouraging local investment in mining, smelting, and value added copper products. Brazil also is increasing its participation in copper alloys, scrap, recovery, and copper based components, all of which strengthen its influence.

More Insights in Towards Chemical and Materials:

- Copper Wire Market : The global copper wire market size accounted for USD 159.25 billion in 2025 and is forecasted to hit around USD 284.27 billion by 2034, representing a CAGR of 6.65% from 2025 to 2034.

- Copper Foil Market : The global copper foil market volume is calculated at 387.50 kilo tons in 2024, grew to USD 415.07 kilo tons in 2025 and is predicted to hit around 770.50 kilo tons by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034.

- Asia-Pacific Copper Market : The Asia-Pacific copper market size is calculated at USD 180.91 billion in 2024, grew to USD 192.92 billion in 2025, and is projected to reach around USD 344.08 billion by 2034. The market is expanding at a CAGR of 6.64% between 2025 and 2034.

- Europe Copper Market : The Europe copper market size is calculated at USD 50.45 billion in 2024, grew to USD 53.1 billion in 2025, and is projected to reach around USD 84.16 billion by 2034. The market is expanding at a CAGR of 5.25 between 2025 and 2034.

- Green Steel Market ; The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

- Building & Construction Materials Market : The global building and construction materials market size was valued at USD 2.19 trillion in 2024, grew to USD 2.32 trillion in 2025, and is expected to hit around USD 3.90 trillion by 2034, growing at a compound annual growth rate (CAGR) of 5.95% over the forecast period from 2025 to 2034.

- Water & Wastewater Treatment Market : The water & wastewater treatment market size is calculated at USD 348.19 billion in 2024, grew to USD 371.00 billion in 2025, and is projected to reach around USD 656.68 billion by 2034. The market is expanding at a CAGR of 6.55% between 2025 and 2034.

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

Copper Market Top Key Companies:

- Codelco

- BHP Group

- Freeport-McMoRan Inc.

- Glencore International AG

- Jiangxi Copper Corporation

- Anglo American plc

- First Quantum Minerals Ltd.

- Antofagasta PLC

- Grupo México S.A.B. de C.V.

- KGHM Polska Miedź S.A.

- Southern Copper Corporation

- Teck Resources Limited

- Vedanta Resources Limited

- Aurubis AG

- Hindustan Copper Limited

- Sumitomo Metal Mining Co., Ltd.

- OZ Minerals Limited

- China Nonferrous Metal Mining Group

- Boliden AB

- Norilsk Nickel

Recent Developments

- In September 2025, Anglo American and Teck Resources have agreed to combine in a high value all share deal, forming a new entity dubbed Anglo Teck. This merger aligns adjacent copper assets and is framed as a strategic move to bolster scale, cost synergies, and resilience amid tightening supply conditions.

- In October 2025, The market has seen a sharp rally in copper prices, driven by production cutbacks at major mines and speculative interest. Simultaneously, Glencore secured government backed funding to sustain its Mount Isa smelter to prevent collapse of domestic processing capacity.

Copper Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Copper Market

By Product Type

- Refined Copper

- Copper Wire Rods

- Copper Cathodes

- Copper Tubes & Pipes

- Copper Sheets & Plates

- Copper Alloys (e.g., Brass, Bronze)

- Copper Concentrates

By Application

- Electrical & Electronics

- Construction & Infrastructure

- Industrial Machinery & Equipment

- Transportation (Automotive, Railways, Aerospace)

- Renewable Energy (Wind, Solar)

- HVAC & Plumbing

- Consumer Goods

- Telecommunication Infrastructure

By End-User Industry

- Power Generation & Transmission

- Building & Construction

- Automotive & EV Industry

- Electronics & Semiconductors

- Mining & Heavy Machinery

- Marine & Defense

- Healthcare Equipment

By Form

- Bare Copper

- Insulated Copper

- Rolled Products

- Forged Products

- Powdered Copper

- Recycled Copper

By Distribution Channel

- Direct Sales (B2B Contracts)

- Distributors & Wholesalers

- Online Metals Marketplaces

- Metal Exchanges (e.g., LME)

- Stockists & Local Dealers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5672

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.